Delta Neutral Yield

Earn Yield, Hedge Volatility

Toros offers advanced delta-neutral yield strategies designed to generate market-neutral returns by balancing long and short positions. These strategies allow investors to earn yield without direct exposure to asset price fluctuations, making them a powerful tool for risk-managed yield farming.

Toros offers the following delta neutral vaults:

USD Delta Neutral Yield on Optimism (Symbol: USDmny)

Perpetual Delta Neutral Yield (Symbol: USDpy)

USD Perp Liquidity Yield (Symbol: USDply)

What is a Delta-Neutral Strategy?

A delta-neutral yield strategy involves taking simultaneous long and short positions on the same asset to cancel out price exposure while earning yield from incentives and trading fees. The result? Steady returns, regardless of market direction.

A example:

Providing Liquidity (LP): The vault stakes volatile assets like WETH into liquidity pools to earn trading fees and farming rewards.

Short Hedging: To offset price exposure, the vault simultaneously takes a short position (borrowing the asset on Aave).

Smart Rebalancing: As the asset price fluctuates, the vault adjusts both the hedge and the Aave position to maintain a delta-neutral stance.

Built for Performance, Designed for Security

The vault ensures a safe borrowing buffer with a target Health Factor of 1.4, minimizing liquidation risk.

During periods of low volatility, rebalancing costs are minimized, allowing the vault to maximize net yield. No unnecessary adjustments—only when thresholds demand it.

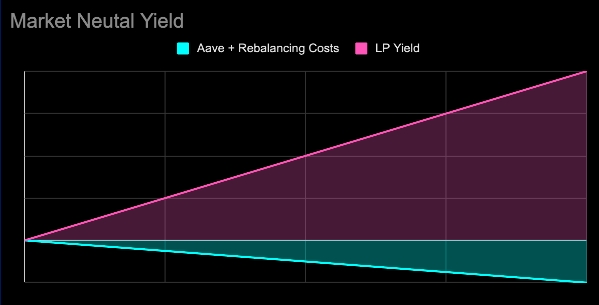

Below simplifies the strategy output once the hedged position cancels out the LP position. Periods of lower volatility result in decreased strategy costs.

Aave+Rebalancing Costs represent the costs of Lending and Rebalancing

Always Hunting for the Best Yield: The strategy actively scans for optimal liquidity pairs that are highly incentivized or low in volatility, maximizing efficiency.

Last updated